The changing face of accounting profession

Afterschool Team

March 6, 2014

There is a growing importance in the contributions of finance talents to improve the economic and social development in Malaysia. Business and economic changes have placed heavy emphasis on the accounting function, and with this, the profession has been steadily adjusting in accordance to these changes.

Growing business complexity continually drives the need for specialized knowledge and more technical skills, states Jennifer Lopez, country head of Association of Chartered Certified Accountants (ACCA) in Malaysia. The general idea that all accountants do the same things is extremely flawed.

Evolving roles

“Accountancy is a field that encompasses work beyond financial and management accounting to include areas such as forensic accounting, business analysis, taxation, risk management, governance, tax and treasure,” Lopez explains. “Consequently, accountants today need to have deeper business acumen balanced with core finance understanding.”

Unlike most professions, accounting is practically recession-proof. Whether in good times or bad, from giant corporations to small private businesses, qualified accountants are depended upon to provide strategic business counsel to keep the business afloat.

“It’s a career which can open the door to thousands of options. Added to that, our country is in need of more qualified accountants if we are to meet our national aspirations for economic progress,” she adds.

Accounting and finance skills are required across all fields of work such as investment banking, corporate finance, and even in entrepreneurship. Today, business leaders rely on finance professionals to counsel beyond the numbers to advice on strategies that are profitable and sustainable.

Riding with technological trends

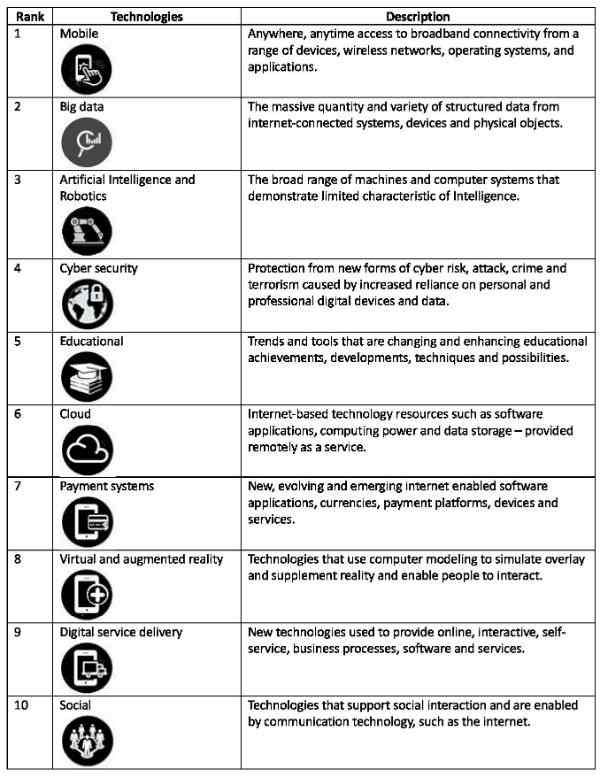

According to a report from ACCA’s Accountancy Futures Academy and Institute of Management Accountants), the global accountancy profession will be impacted significantly by these 10 technology trends:

The top 10 technologies came from a survey of over 2,100 ACCA and IMA members around the world. Looking at specific technologies:

- 84 per cent of respondents in Asia Pacific believe that mobile technology will have the greatest impact on their business in the years ahead.

- Big data on business (76 per cent), and cybercrime (56 per cent) were identified as huge influencers of the profession

- Looking forward, 69 per cent of Malaysian respondents predict that data modeling and analysis skills will be needed, and;

- 74 per cent predict knowledge of data extraction tools in the mining of business intelligence will be crucial.

“We believe that an increasing reliance on technology could see the rise of a new Chief Financial and Technology Officer (CFTO) role in the near future,” says Lopez. “Finance professionals must remember that they are agents of change within today’s businesses, which means they have to be at the forefront of technological developments.”

Is supply meeting demand?

According to forecast, Malaysia will need 60,000 financial talents by 2020. Similarly, Lopez believes that demand for qualified accountants will not ease anytime soon. In fact, she encourages individuals, who are still searching for a lasting career, to consider accountancy.

“There is certainly a steady stream of accounting graduates, but what we have observed is a shortage of qualified accountants,” explains Lopez. Reports claim that companies generally find it difficult to attract accountants who have the right mix of talent and experience.

“By qualified, we refer to finance professionals with the adequate knowledge and skills needed by the industry to fulfill their roles as business advisors.”

More qualified accountants

To address ways to up-skill talents in the workforce, ACCA has been working with local universities and colleges, employers and government agencies.

An example is ACCA’s Certify Me Now! Programme with Talent Corporation for fresh graduates with a degree in accounting and finance, who have worked for a year or less in finance shared services functions or small-medium practioners to take up ACCA qualification.

Another collaboration is with Yayasan Peneraju Pendidikan Bumiputera on the Peneraju Professional – Pensijilan Perakaunan initiative. This programme is targeted at the Bumiputera community, where financial support will be provided to eligible working adults of not more than three years’ experience to take up ACCA qualification.

To date, there are a few Bumiputera pursuing accountancy. According to Malaysian Institute of Accountants (MIA), they have slightly over 28,000 registered chartered accountants in business and commerce, public practice, public sector and academia. MIA hopes to see more Bumiputera chartered accountants as they currently constitute only 28 per cent of the total membership.

“Ultimately, the aim of entering into all these partnerships is to provide people of all backgrounds with greater access to acquire a globally recognized professional accounting qualification that will prepare them into complete financial professionals,” says Lopez.

###